Flutterwave and Acquired.com collaborate for seamless outward card payments on Send App for EU and UK users

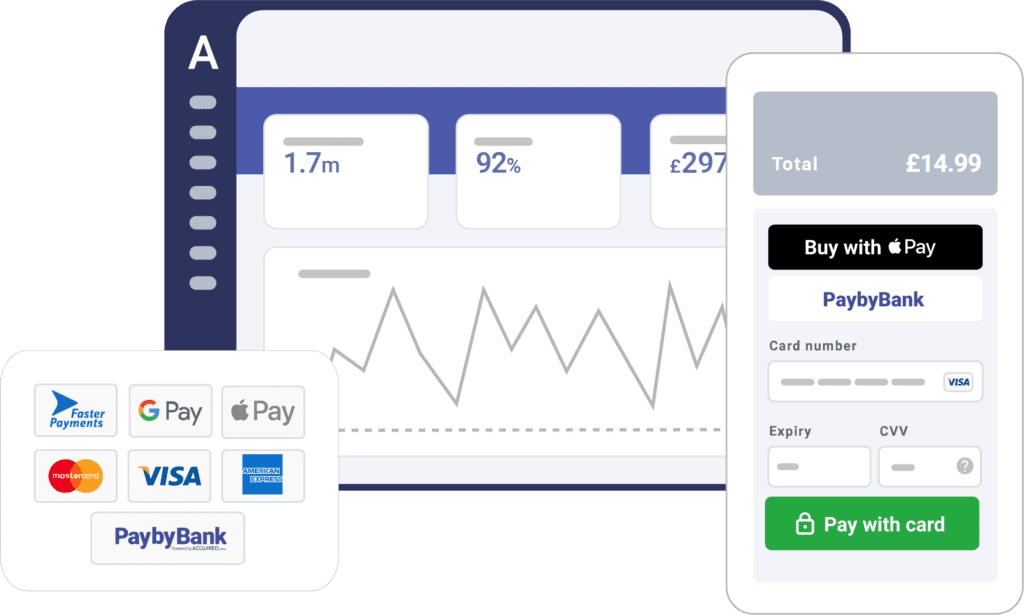

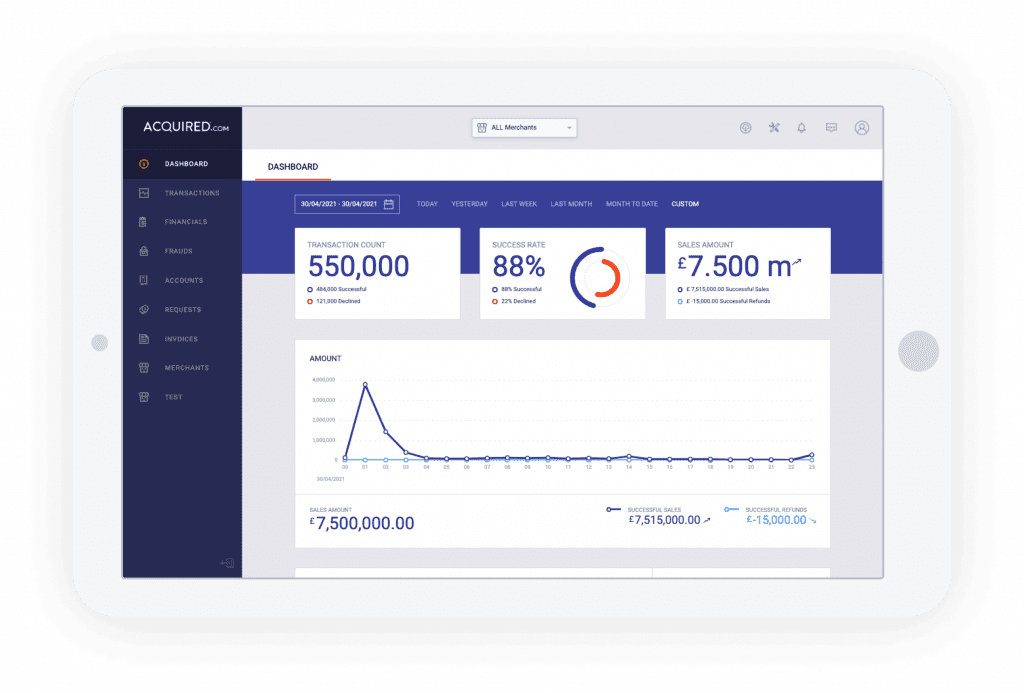

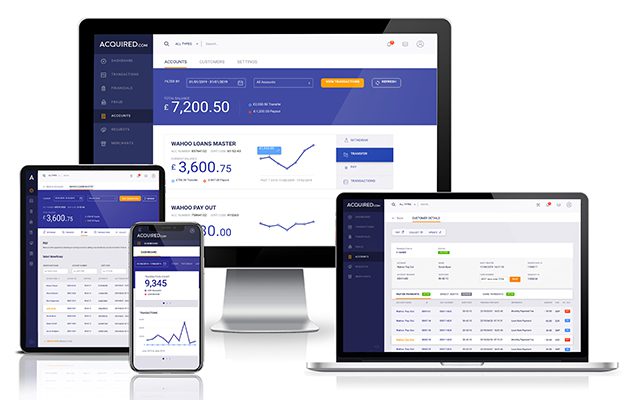

London, 25th April 2024 – Flutterwave, Africa’s leading payments technology company, has partnered with payment processing specialist, Acquired.com, to help users process domestic card payments…

Insights, News