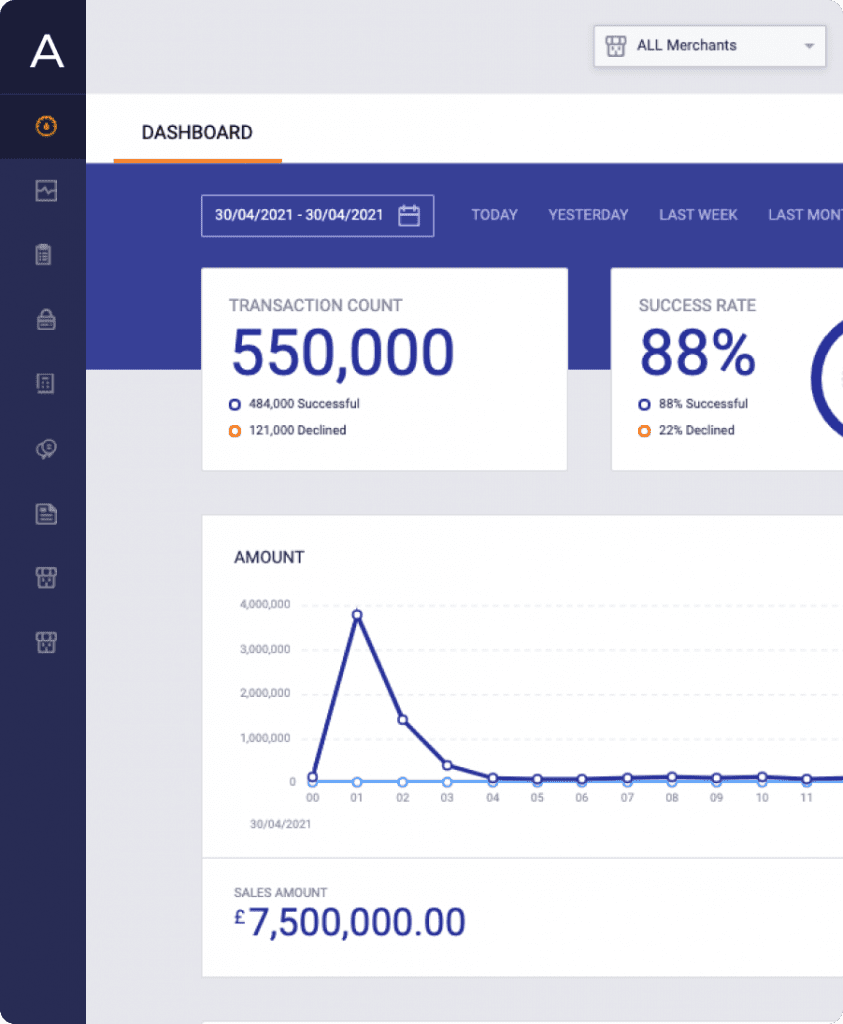

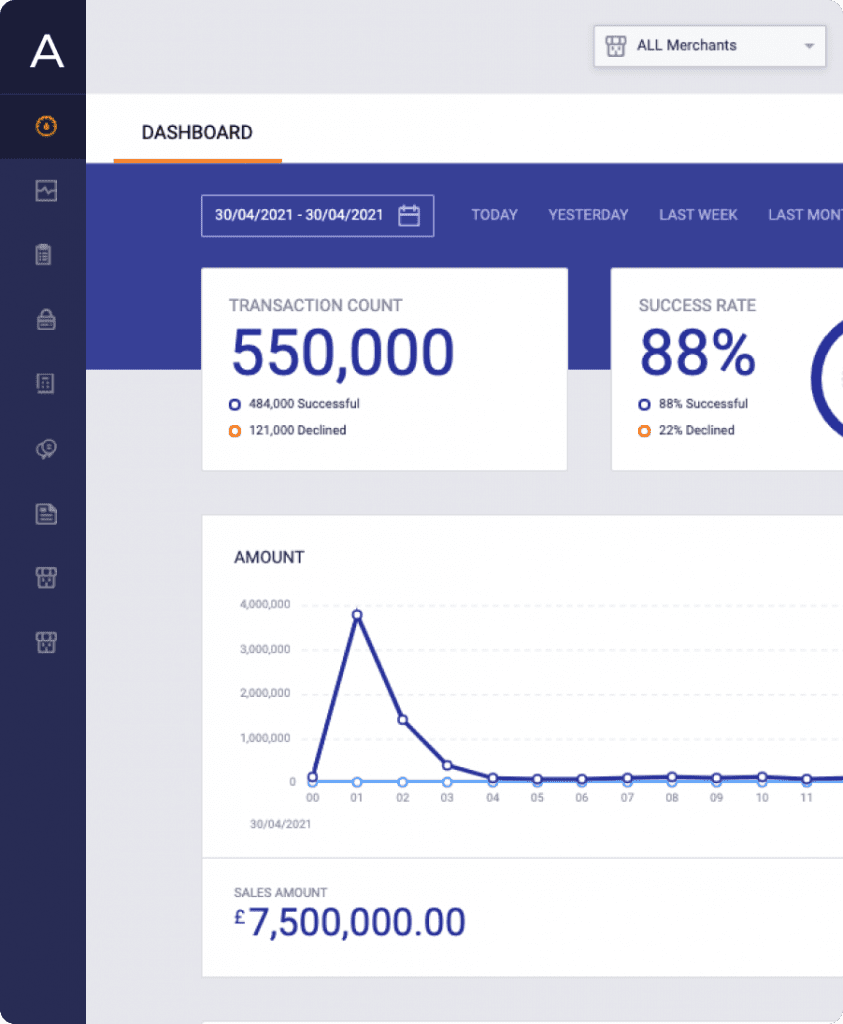

Avoid declined payments and improve your acceptance rates

Out-of-date payment information can result in involuntary churn, lost revenue, and reduced customer satisfaction. Account Updater is an efficient and cost-effective way for your business to avoid declined payments based on out-of-date card and account details.

Seamlessly process recurring payments

See how the Account Updater solution can save you time & money by reducing manual updates.

What is Account Updater?

Acquired.com‘s Account Updater service can automatically update your customer’s card information whenever it changes, this includes card numbers, cardholder name, card providers and expiration dates.

By checking for updates from Visa & Mastercard in real-time, your team will no longer need to chase your customers to update their details manually, and your next billing cycle will use the most up-to-date information available.

With Account Updater, the frequency of declined payments from expired cards or out-of-date details is significantly reduced, all without any input from customers!

What are the key benefits?

Fully automated process

The Acquired.com team can build Account Updater into your own payment flows or the service can be fully automated. When the system is automated, an Account Updater request is triggered in the event that a recurring payment is declined.

Reduce operational costs

As the customer doesn't have to manually update their details, the Account Updater service helps to boost customer loyalty through uninterrupted payment cycles, as well as dramatically reducing operational costs.

How does Account Updater work?

We offer a consultative approach and can tailor the Account Updater service to best suit your business. However, our core Account Updater process looks like this:

- Each month, prior to your next billing cycle, Acquired.com will proactively check the card details for all the tokenised cards you have stored with us that are about to expire.

- We will receive a response back from the card schemes for all matched and updated cards.

- If new details are available, we will automatically update the tokenised card information within our environment with the new details.

- The new card information is set then as the default payment method.

- We will inform you of this update via webhook notification.

- Once a card is updated, when the next payment attempt is due to take place, the request should be successfully authorised.

Seamlessly process recurring payments

The Acquired.com Account Updater service is unique as we update the original payment token stored by the merchant when we run the system. This results in no changes on your side, allowing you to seamlessly process recurring payments.

Our solution can also update payment tokens that are due to expire in advance. On a regular basis or recurring dates, the Acquired.com Account Updater identifies existing payment tokens/payment methods that are due to expire and completes an Account Updater request ahead of expiry. This means that payment runs have a higher chance of being successfully authorised and failed payments become less likely.

Of course, this isn’t always possible for cases where cards are cancelled, lost or stolen, but payment failures caused by regular card expiry can be almost completely eliminated using our Account Updater service.

We’ll send you a notification of every Account Updater result through the Acquired.com Hub. This allows you to build and integrate your own automated processes to ensure that customers are notified as soon as their account details need to be updated. This also provides you with details of customers with inactive payment methods and allows you to track them within your system.

Which card types are supported?

Currently, Mastercard and Visa are both supported by Account Updater. American Express is not currently supported.

Using Account Updater the Acquired.com system will reach out to Visa and Mastercard for updated card details for any lost, stolen or expired cards and update them on your behalf - you don’t need to do anything!

Save the time & cost of manual updates

By regularly checking these details against your existing customer database, we can help our merchants reduce the number of declined payments on the grounds of out-of-date information.

The standard method for merchants to update account information before the development of Account Updater was to regularly submit a batch showing the existing card information, and then request Visa or Mastercard to check for any updates. These updates would then be processed and ready for the next billing cycle.

However, this is a relatively slow process and requires several days to accumulate data from all of the relevant card networks and issuers. Additional time is also needed to collate a response file and share that information with merchants, by which time more details may have changed.

Alternatively, merchants would need to wait until payments actually failed before taking any action and then send requests to users in the cases of failed payments. Users would need to manually re-enter their details into the payment system for each individual merchant that uses those details.

A huge benefit of the Account Updater solution is that it automatically keeps on top of your customers’ tokens. This eliminates the need for direct customer communication to update payment details. It also increases your authorisation rates as you have card numbers and expiration dates updated when you need them.

How recurring payments work

Customers authorise merchants to automatically withdraw funds from their accounts on a regular basis for goods and services they receive on an ongoing basis. The merchant will automatically deduct the amount at predefined intervals the customer’s permission is retracted or the subscription expires. There are generally two types of recurring payments: regular or fixed recurring payments and irregular or variable payments.

Fixed recurring payments

Whenever a customer makes a fixed or regular payment, they are charged the same amount each time, for example, gym memberships, streaming subscriptions and phone contracts.

Variable recurring payments

A variable recurring payment, on the other hand, is one in which the amount charged changes based on the customer's use of the product or service. Electricity and other utility bills, for example, can change month by month based on consumption.

The advantages of recurring payments

Less time spent on administrative tasks

With automated recurring payments, invoicing and payments can be handled more efficiently and cost-effectively. Once you set up the payment plan, the software will handle the payment processing for you. As a result, your business will spend less time chasing down late payments, leaving more time for other important tasks.

Improved protection against fraud

As recurring payments use the same details every time, and the Account Updater takes care of any updated details automatically, reducing the likelihood of fraudulent payments. Prevention technologies like tokenisation also save resources that would otherwise have to be used to detect and resolve fraud.

Improved customer relationships

Since customers only have to enter their billing information once, recurring payments are highly convenient. Recurring payments deduct funds from their bank accounts automatically on the appropriate billing date, helping build strong customer relationships and increase loyalty without additional effort from the merchant.

Reduced late payments

In addition to affecting revenue, late payments also damage customer relationships. The recurring payment system allows you to configure it once and rest assured that it will collect payments automatically according to your schedule.

FAQs

Some providers utilise a real-time account updater, which is used to immediately check declined payments due to incorrect card details with Mastercard and Visa, and retrieve updated details in real-time. If new card details are available, the tokenised card information is updated and therefore next time the payment is attempted, the request should be successfully authorised. This all happens in real-time without having to inform the customer or ask them for additional details.

At Acquired.com, our core Account Updater process has been built in line with the needs of our customers. Every billing cycle Acquired.com will proactively check the card details for all the tokenised cards a customer has stored with us to avoid any declined payments where possible, and improve authorisation rates.

During this process, all the tokenised card details will be checked in a batch process several business days in advance of your usual collection date. Any credit cards or debit cards that come back as invalid, lost, stolen, or expired will be logged, and the card issuers contacted. If updated information is available, Acquired.com will automatically replace the old payment card details with new ones and save them for future use.

Yes, customers can opt out of the account updater service by contacting their bank or card provider.

Your customers may have concerns about using account updater. In that case, it is worth advising them on how account updater works and the benefits of the service, as it remains an incredibly secure solution.

Using account updater, cardholder data is not shared with any party that wouldn’t be able to access the data through the traditional manual process (the individual, their bank, the card scheme, and the merchant). All the account updater service does is offer a seamless process by removing the need for the customer to manually update their card details on a business’ portal themselves.

Yes, with Acquired.com’s account updater, credit cards automatically update when they are reported as lost/stolen, or expire. Account updater is available for Visa and Mastercard credit cards (regardless of who the user banks with), and means customers don’t have to worry about manually updating their card details with businesses like subscription services, memberships or other recurring payments using continuous payment authority (CPAs).

American Express is currently not supported by account updater, so these credit cards will still need to be updated manually in the event an of card declines due to incorrect payment information.

Automatic billing updater (also known as ABU or Mastercard ABU) is a Mastercard-only service that allows expired Mastercard credit cards or debit cards to be automatically updated in the event that cards are lost, stolen, damaged or expired, without having to send customer notifications asking them to manually update their card details. This allows businesses who work with Mastercard to offer more streamlined customer experiences and to reduce the number of card billing info updates that customers have to carry out, keeping their subscriptions/payment schedules running without a hitch.

Visa Account Updater is the software that Visa uses to automatically update user card details on behalf of businesses. Visa Account Updater (or VAU), allows customers to use the same card to make recurring payments with a merchant, even when their card details change (usually if the card is lost, stolen or expires).

VAU will automatically pull new card details from Visa when the original card declines, and then replace and save them for future use. Customers can also cancel their recurring payments whenever they wish, without having to contact your business.

The Acquired.com account updater works with both Visa Account Updater and Mastercard Automatic Billing Updater to provide merchants with support across both of these major card networks.

Yes, automatic billing in conjunction with an account updater solution is secure.

Automatic billing using credit cards and debit cards is generally done using a continuous payment authority (CPA). CPAs are used to remove friction from a recurring payment process and improve customer satisfaction, but they need to be carried out seamlessly in the background to prevent involuntary churn. This is where account updater comes in.

Instead of manual updates needed by the customer if their card expires or is lost or stolen, account updater contacts the card provider every billing cycle to carry out automatic updates of the card details on file. This process is carried out automatically by Acquired.com, offering a seamless experience to not just end-users, but businesses too.

Business owners don’t take on any additional liability when using account updater for their automatic billing, and that customer data isn’t shared with any party that wouldn’t hold the data if the user were to manually update their card details.

Card issuers are the main owners of card updater programmes. Visa was the first card network to implement this technology, and VAU (Visa Account Updater) is still often used as a catch-all term. MasterCard also offers account updater technology called Automatic Billing Updater.

When a payment request is due to be made, Acquired.com will check all of the tokenised cards stored on file for your business to get payment authorisation approvals ahead of the payment date.

If any cards come back declined, we’ll make a request to the card provider who will be able to confirm if new card details are on file and if so, will send these back to Acquired.com, without any input needed from individual card users.

Finally, Acquired.com will update the card billing information for a customer with the data from the card network, and save this for future use.

Account updater technology couldn’t exist without the participation of credit card issuers, but our clients will have contact with us, not with the card networks when it comes to our account updater service.

Having strong processes in place to contact customers when their cards need to be updated is a good place to start, but this can often be time consuming and expensive to organise manually. The most effective way to maintain up-to-date customer card information is by using an automated account updater service.

One of the most common challenges faced by businesses with high volumes of recurring payments is maintaining up-to-date card information. Having up-to-date payment details from customers ensures that payments can be collected promptly and without incurring additional costs caused by declined payments. Account updater reduces the work needed by businesses to improve their recurring payment acceptance rates.

Any business that takes recurring payments using a continuous payment authority (CPA) can benefit from account updater. This includes:

- Organisations that require recurring payments, such as loan providers.

- Organisations that offer finance plans for high-value products/services

- Utility companies that take payments every month

- Subscription-based services like gym memberships and streaming services.

- Product-based subscriptions like cleaning products or personal care products.

- Organisations that require customers to renew their memberships on a monthly/quarterly/annual basis.

There are many reasons why a recurring payment might fail, but the one most common reason is that a customer’s card has been lost, stolen, or expired.

If a customer’s card is lost or stolen, it will be immediately frozen or cancelled before the customer gets their new card, and before it is activated. This means that if customers have to manually enter their card details, there will be a gap in which their old card can’t make payments, and their new card hasn’t been entered into the business database yet. Any payments taken during this period will fail. With an account updater service, the tokenised card details are updated as soon as the new card is active, minimising this window and helping ensure your card payments are completed successfully.

When a card expires, customers will get their new card before the old one is deactivated. However, they will still need to manually update their details which can increase the number of failed payments your business has to deal with. Even if the new card is added quickly, each failed payment represents a cost to your business, which is why account updater is so valuable to organisations taking recurring payments.