Abound distinguishes itself in the lending landscape by leveraging ‘financial x-rays’ through AISP Open Banking to ensure fair credit decisions and broaden access to affordable credit. They analyse live financial data using Render, their proprietary AI software, which allows them to understand each applicant’s unique financial situation and what they can truly afford to borrow.

Acquired.com were chosen by Abound for our adeptness in meeting intricate payment needs, coupled with a consultative approach. Through Acquired.com’s data-rich platform, Abound has insight into the entire customer journey, optimising efficiency and enhancing the customer experience.

In this case study, we examine how Abound, supported by a multi-acquiring strategy, achieved unparalleled success in payment processing while upholding its commitment to responsible lending practices.

Background

With a mission to make fairer credit decisions and expand access to low-cost credit, Abound prioritises understanding borrowers’ financial situations. However, facilitating seamless payment processing is essential to sustaining their mission and ensuring positive customer experiences.

The Challenge

Despite employing innovative affordability assessment tools, Abound faced challenges in optimising their payment processing. Relying solely on a single acquirer limited transaction approval options, payment flexibility, and introduced risks.

For example, when choosing to work with a payment processor that is connected with only one acquirer, all of Abound’s transactions would be routed through a single acquiring source. In the event of downtime or issues with the acquirer, the payment process could face interruption rather than transactions being seamlessly rerouted to alternative acquirers.

Abound also required further data insights into their transactions, so they could continue to improve their payment processes and collection rate success.

Acquired.com’s Solutions

To address these challenges, Abound embraced Acquired.com’s next-generation platform equipped with a multi-acquiring strategy and data-driven approach to payments.

The approach empowered Abound to diversify their payment channels across multiple acquirers, ensuring smoother transactions, increased flexibility, and enhanced risk management. The adoption of a multi-acquiring strategy provided Abound with several key benefits:

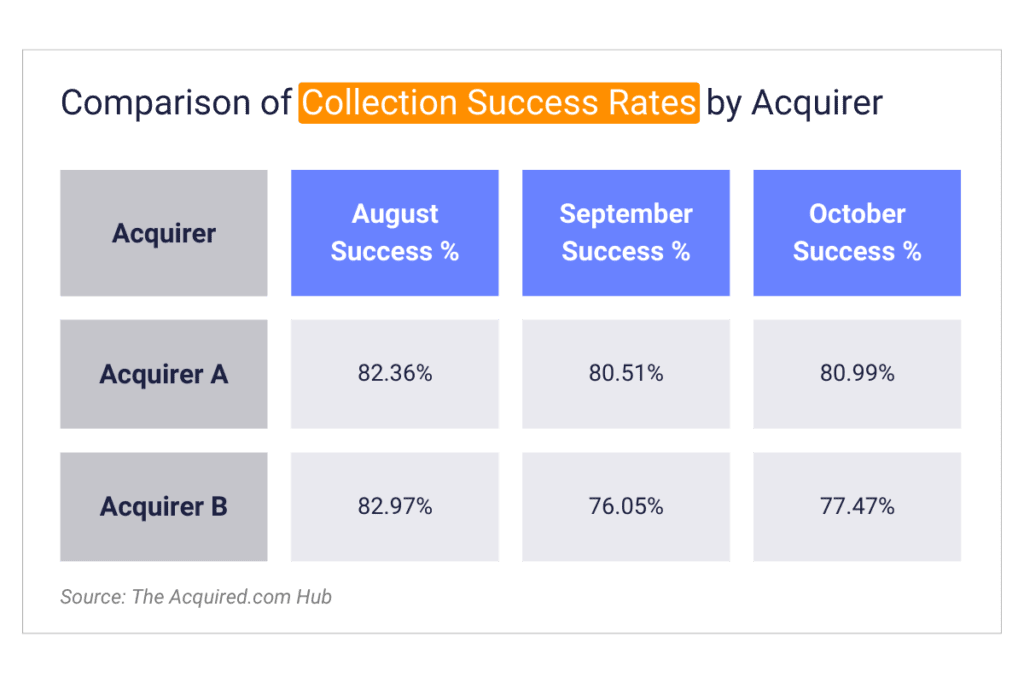

Enhanced payment success rates – Leveraging multiple acquirers led to improved payment success rates, enabling Abound to facilitate seamless transactions for borrowers. As seen in fig. 1, relying on Acquirer B only for September and October could have resulted in Abound seeing up to 6% lower collection success rates. Instead, the multi-acquiring strategy showed Abound which acquirer achieved higher success rates for each month, and allowed them to reroute their transactions accordingly.

Increased flexibility – Routing transactions through multiple acquirers granted Abound greater flexibility to adapt to changing market dynamics and customer preferences.

Risk mitigation – Diversifying payment channels reduced the risk associated with relying solely on a single acquirer, safeguarding Abound against disruptions in the payment ecosystem.

At Acquired.com, we also provide businesses with the opportunity to review, measure, and control their payment landscape by utilising acquiring data in an interactive analytics and reconciliation platform that brings together all payment activity. This data-driven approach supported Abound in understanding their collection success rates and allowed them to implement solutions to ultimately improve these rates.

At Acquired.com, we also provide businesses with the opportunity to review, measure, and control their payment landscape by utilising acquiring data in an interactive analytics and reconciliation platform that brings together all payment activity. This data-driven approach supported Abound in understanding their collection success rates and allowed them to implement solutions to ultimately improve these rates.

For example, the data gathered in the Acquired.com Hub showed that in October and November, 5% of transaction declines were caused by ‘SCA Failed’. SCA regulations require customers to complete additional steps to verify their identity during payment. After uncovering the prevalence of this decline reason, Acquired.com supported Abound in exploring the implementation of Apple Pay as a payment method. Apple Pay has built-in layers of authentication that inherently allow transactions to meet all SCA requirements, potentially allowing Abound to reduce these transaction declines.

Providing a data-rich view of all transactions to Abound has been an extremely valuable experience for them, as it has allowed them to explore making informed decisions that could ultimately lead to increased success rates and improved borrower satisfaction.

The Outcome

Abound’s success story demonstrates the importance of a multi-acquiring and data-driven strategy in optimising payment processing for lenders. Abound seamlessly integrated multiple acquirers into their payments infrastructure, leveraging their respective strengths to optimise success rates and accommodate diverse payment types. By adopting this approach, not only did they achieve success in payment processing, but they also upheld their mission of making fairer credit decisions and expanding access to affordable credit.

Improving Abound’s visibility over their decline data has also bolstered their data-driven payments strategy by informing better decision-making and ultimately improving collection success rates.

As the lending landscape continues to evolve, embracing these strategies has emerged as a vital component for sustainable growth and customer satisfaction in the lending industry.

Want to listen to the recent podcast with Abound? Click here to tune in!

About Abound

Abound is a financial service that uses Open Banking and artificial intelligence to provide borrowers with more affordable loans compared to traditional lenders. Founded in 2020 by a team of credit experts with decades of experience, as well as first-hand experience of poor lending practices, Abound is the consumer arm of Fintern Ltd, which also owns Render – the proprietary technology being used by Abound to deliver smart loans.

Abound is authorised and regulated by the Financial Conduct Authority, a member of Cifas (the UK’s leading anti-fraud association) and registered with the UK Information Commissioner’s Office in compliance with the Data Protection Regulations 2018.

For more information on Abound, visit their website www.getabound.com

About Acquired.com

Acquired.com have built a next-generation payments platform focused on powering recurring commerce and the digital economy.

We exist to give businesses competitive advantage and help them achieve their goals in the digital economy. Acquired.com provides businesses with next-generation payments infrastructure and technology that allows businesses to unify, manage and optimise the entire payment lifecycle across payment methods, through a single strategic and commercial relationship.

In addition to next-generation capabilities, our merchants benefit from exceptional sector expertise and a highly personal and tailored service focused on long-term partnerships with our clients.

Acquired.com are an FCA-regulated business, an EMD Agent, and a licensed Payment Initiation Service Provider.