Empowering your customers

A better way for customers to pay

Google Pay™ is protected with multiple layers of security and provides a simplified checkout experience with no maximum transaction limit when using phone and card.

Implementation

Accepting Google Pay

The Acquired.com Hub provides a step-by-step guide to add Google Pay™ as a payment method, depending on the needs of your business. Once your business is integrated to the Acquired.com API, in a few short steps you can start accepting Google Pay™ on your website and Android App.

What is Google Pay, and How Does it Work?

Google Pay is a mobile payment wallet that allows users to pay quickly and safely for goods with their mobile device. Both contactless in-person transactions and online transactions can be carried out using Google Pay. Worldwide, Google Pay has millions of cards saved for users, keeping their card details safe yet accessible with just a couple of taps! Google Pay is available in 40 countries and has over 100 million users, making it an incredibly profitable market to access.

For companies and merchants, the integration process for Google Pay is incredibly simple, and with Google Pay built into the Acquired payments processing platform, it’s even easier.

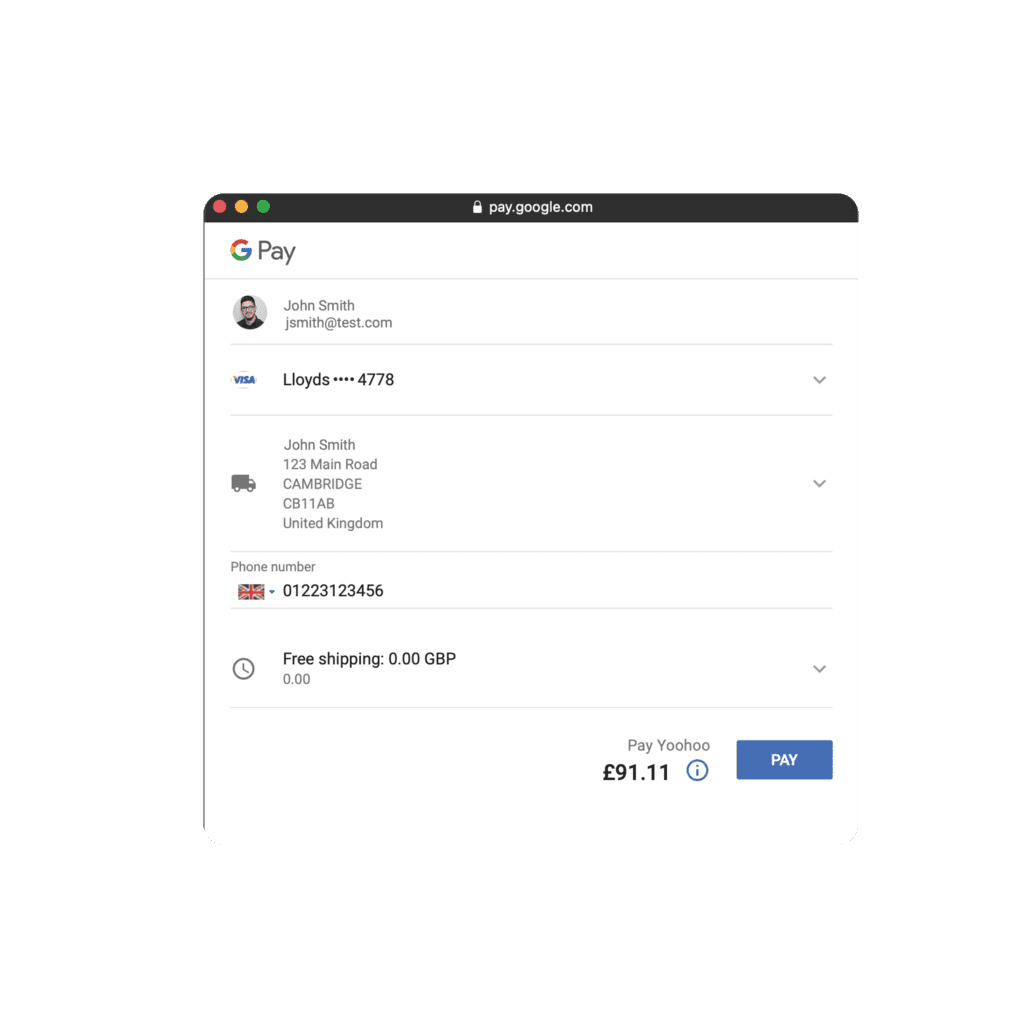

For users, the experience of using Google Pay allows them to bypass traditional online payments that require lots of different steps in the payment process, removes the need for messing around with a stuffed wallet or too many cards, and also keeps everything nicely organised in one account, rather than having to use multiple IDs or accounts – as can be the case with other payment wallet apps.

The Google Pay Process

- When a user first clicks the Google Pay payment button, they'll be given a popup payment sheet, displaying all of the payment methods that have been previously saved to their Google Account. There are also options to autofill billing and shipping address fields. Alternatively, users can add new cards or addresses at this point.

- The user selects their chosen payment method with just a few taps!

- A payment token for the chosen payment method is then securely returned to your website by Google Pay.

- This payment token is sent to your website's backend, along with all of the relevant information about the purchase.

- In order to complete the transaction, the backend processes the purchase and transmits the payment token to the payment service provider.

- Your payment service provider will then process and log the payment, before ensuring funds are transferred to you.

How Google Pay Integration Can Benefit Your Business

Google Pay and other mobile payment providers (like Apple Pay, Samsung Pay, or Android Pay), can have a huge impact on the overall effectiveness of your payments strategy. By removing common customer issues and barriers, you can create a seamless checkout process for your users that allows them to make purchases quickly and easily, without any hassle! The key advantage of Google Pay is that it makes payments simple for your users. At the end of the day, finding ways to make the process of purchasing from your app or website as easy as possible is exceptionally important to your bottom line, as a poor user experience will lose you customers. The key to building an excellent customer experience when it comes to making payments within your organisation, is to keep the process as quick and effortless as possible. Traditional payment methods like credit or debit cards require users to enter their card number and security code, cardholder details, their billing address, their shipping address, their preferred delivery method and sometimes even more. Google Pay allows users to enter all of this information in only a few taps, resulting in a quicker transaction and better conversion rate.

While many users now also use autosave features within their browser for their card and shipping details, the additional security that Google Pay provides customers is a significant bonus. All Google Pay transactions have to be approved using fingerprint recognition and biometrics, or an unlock code for your phone. This means that users can store their cards and know that their details will be held securely on all sites. It's incredibly important to note that in today's e-commerce landscape, mobile wallets aren't just an extra convenient bonus for your customers - they are the standard. Studies estimate that in 2020, over 20% of all payments were made using a mobile wallet like Google Pay, Apple Pay or Android Pay. This does take into account in-person payments as well, which have also grown in popularity as a result of the COVID-19 pandemic and the convenience it offers to users. Mobile wallets are also more popular with younger generations, with millennials and Gen-Z considerably more likely to use mobile wallets than baby boomers. Younger people are often early adopters of new technologies like these, and they are also the ones most likely to shop online. For e-commerce businesses, this demographic is an incredibly important one to cater to, and by integrating Google Pay and other payment wallets, you can do just that.

The Advantages of Accepting Google Pay

Seamless payments in your apps or websites

Your customers can use Google Pay to pay with a single click, using payment methods previously saved in their Google Account. Whether you need a payment provider for your app or your website, our team of experts will be able to help you and your developers set up the Acquired integration, including Google Pay. By integrating Google Pay, you're making the lives of your customers easier, thereby reducing your cart abandonment rate and increasing conversions.

Users can add loyalty cards or gift cards

One of the features that sets Google Pay apart from other payment providers and mobile wallets is the ability to add gift cards and loyalty cards to your wallet as a payment method. Users simply need to scan the card or sign into their loyalty account in order to save the account to your Google Pay account. Gift cards on a payment card network (such as Visa or MasterCard) can also be added. However, these cards need to be added as their own payment method, rather than as a gift or loyalty card.

Increased security

With Google Pay, users and payment providers have the benefit of working within Google's own security parameters. All customer payment data is end-to-end encrypted. This means that it remains safe and secure all the way from Google's servers to your payment processor. As this data remains encrypted throughout the process, merchants don't need to hold sensitive user data. This means that the data merchants need to hold is less sensitive and more secure for users in the event of a data breach. In addition, since Google Pay stores, checks and verifies real cards in a user's digital wallet in advance, there is very little risk of a user using a false or fraudulent credit or debit card.

Easy integration

Just a few lines of code will enable Google Pay to work with your existing payments system. Plus, with Acquired's Google Pay integration, you'll have our team of integration experts on your side every step of the way. Your developers will have all of the support they need, whether it's by phone, email or live chat!

Setting up Google Pay for Your Business & Integrating with Acquired

For organisations setting up Google Pay independently, there are just a few simple steps your developer will need to go through in order to carry out payments via Google Pay effectively. The first step is to integrate directly with Google Pay. The Google Pay button can be added to your checkout page and you can begin requesting customers’ encrypted payment information as soon as the initial integration is complete.

The integration process is incredibly simple, and there are many resources available to help development teams carry out the process quickly and easily:

- Review the developer documentation from Google - like all Google products, there is extensive developer documentation available to help your dev teams.

- Get access to the APIs through Google's business console.

- Integrate and test - your development and testing teams will be able to carry this out, in line with developer documentation.

- Go live!

Requirements for Google Pay Integration

It’s very simple to integrate Google Pay with a range of apps or websites, however there are a few prerequisites needed before you get started:

- A Google Account

- A supported payments gateway (such as Acquired), or a Payment Card Industry Data Security Standard (PCI DSS) compliant server environment - you need a server that is suitable to store both encrypted and decrypted payment information

- A list of fully domains, including subdomains which will call the Google Pay API

- After your website is approved, you'll also receive a Google merchant ID. This merchant ID must be included with each Google Pay API request to ensure payments are carried out safely for users and to prevent fraudulent merchants on the platform.

Google Pay FAQs

Is Google Pay a payment processor?

Google Pay is not a payment processor or payment gateway, but instead a way for users to store their debit card or credit card details on their phone or tablet. Google Pay auto-fills not just card details, but also shipping, billing and delivery details for customers, making the process of paying online or with a mobile app as quick and seamless as possible. You can also use PayPal within Google Pay, provided you have set up your PayPal account within Google Pay already.

How much does it cost to integrate Google Pay? Is Google API Integration free?

Yes, Google Pay's API integration is free. However, as Google Pay is simply another payment method (like a credit card, debit card or PayPal), you will still likely be charged by your payments provider. At Acquired, Google Pay integration comes at no additional costs to our customers, so your billing from us will remain consistent.

How to integrate Google Pay in iOS

It is incredibly easy to integrate Google Pay in iOS. While Apple Pay is the native mobile payment option for iPhones, iPads and Apple Watches, Google Pay is still available on these devices. Google Pay can also easily be integrated with iOS apps in the App store, meaning that payments can be carried out in-app or on Google Pay - through whichever payment method the customer prefers. The same goes for Android devices - while Android Pay is native for most Samsung, Sony or Nokia phones, the Google Pay app is available and can be used by users on any of these devices.

Is NFC needed for Google Pay?

Near Field Communication (NFC) is needed to make all contactless payments, including with Google Pay. However, for online payments with Acquired and other online payment gateways, NFC is not required, as the payment process is completed entirely online.