Establishing your customers preferred payment methods is an important consideration in any business’ payments function, particularly businesses who have a large proportion of transactions that take place remotely, such as over the internet, through payment links, or over the phone.

Ignoring your customers’ payment preferences can introduce friction into their buying journey and make your competitors a more welcoming alternative. Addressing them, however, can increase conversion, improve customer loyalty, and reduce churn.

Acquired.com recently conducted some research to see which payment methods are preferred when shopping online. We found that 68% of respondents liked using Apple Pay or Google Pay as their preferred payment method, compared with 29% for Debit & Credit Card, and 3% for Open Banking. This result suggests that the majority of consumers want to use familiar, frictionless payment methods.

It’s important to recognise that although digital wallets were highly favoured as a payment method, no single option enjoys complete market dominance or comes close to universal customer preference. To provide the utmost flexibility and ensure your customers have the best payment experience, it’s essential to maintain a variety of payment methods.

The selection of methods for your payments toolkit should be informed by preference data, which can vary based on your business type and the markets you serve. Additionally, take into account trade-offs with other vital payment factors, such as cost and authorisation success rates, when making the choice about which methods to offer.

Why should you provide your customers with a variety of payment options?

Customer expectation and convenience

The global average for shopping cart abandonment in the retail industry is 72.8%. Furthermore, 73% of customers will abandon a poorly designed website in favour of one that makes purchasing a product or service easier. Sluggish checkout processes, which cause shoppers to hesitate and eventually leave, are one of the factors driving this large number.

Consumers today expect businesses to address their needs head-on. By providing a variety of payment options, you will establish yourself as a forward-thinking company that prioritises the needs of its customers. As a result, your business’ visibility will increase, as will your sales. Increasing the number of payment options available will also reduce the amount of hesitation people have when making a purchase.

Growing Your Customer Base

You can make a better-informed decision on which payment options are best suited to your audience by taking the time to get to know your customers based on your products or services, brand mission, buyer personas, and data based on previous purchases or customer engagements.

If you are looking to grow your customer base, it is wise to offer a variety of seamless payment options which cater to different generations and demographics of shoppers. For example, Gen Z and millennials have been found to prefer alternative payment methods such as in-app purchasing, digital wallets, and mobile payments, whereas older generations generally prefer debit or credit cards. Set up a variety of payment options across your main channels and touchpoints to encourage a larger audience of customers to buy from you, and they’ll be more likely to come back.

Building Brand Trust

Consumers value trust in today’s retail environment. You will reach more customers and retain the majority of them if your brand is perceived as transparent and trustworthy. Offering multiple payment options is an effective way to build trust, which is a sustainable growth tool for modern commerce or ecommerce businesses. Having a consistent mix of secure payment options will make your customers feel valued and safe, and your revenue will rise in tandem.

Remain reactive to your customer payment preferences

Once you’ve invested time in understanding your audience, consolidate your knowledge by delving deeper into available payment methods. Armed with this information, you can confidently determine which payment options to integrate into your website or online store, tailored to your audience’s requirements and preferences.

Once your payment methods are operational, it’s essential to monitor your sales sources closely to identify the most effective ones. Any payment methods that see infrequent use and occupy valuable space in your checkout process can be substituted with more streamlined alternatives, there is such a thing as too many payment options!

An all-in-one solution that delivers multiple payment methods

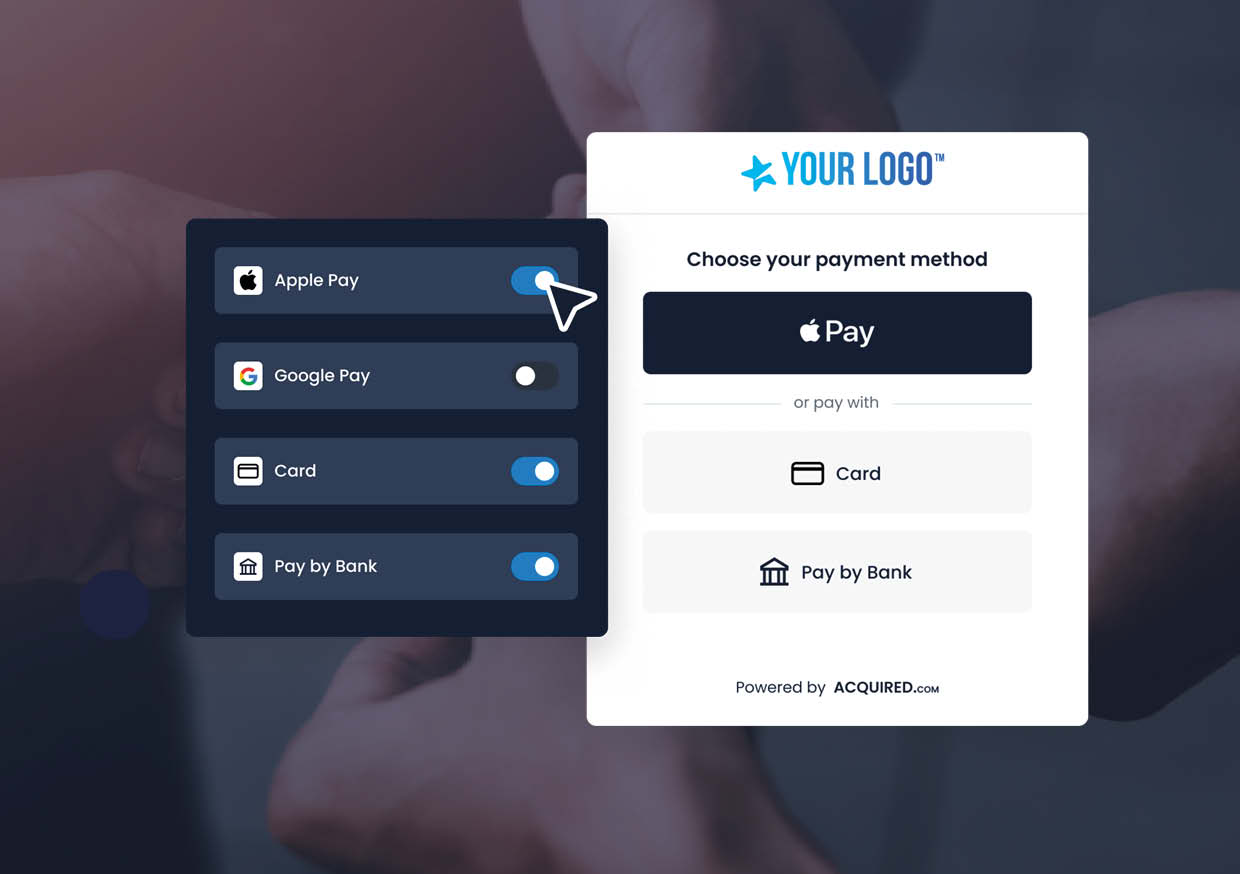

Acquired.com’s Hosted Checkout is a pre-built, highly customisable and quick to deploy solution that allows merchants to accept credit and debit card, Apple Pay, Google Pay and Open Banking payments through a single integration. The solution addresses the financial and operational burdens faced by merchants undertaking multiple integrations in order to offer different payment methods to their customers.

With our Hosted Checkout solution, you can enable and disable payment methods without the need for any coding. For businesses looking to integrate digital wallets including Apple Pay and Google Pay alongside card payments, Hosted Checkout eliminates the need to create a developer account and submit an application to Apple and Google directly, in addition to streamlining the technical aspect of integration.

Additionally, the ability to offer Open Banking payments, a payment method that is yet to see widespread use in many sectors, alongside other payment methods and without the need for a separate integration, can be a game changer for forward-thinking businesses.