Over 60 countries globally have open banking initiatives live or imminently planned. The legislation that enabled open banking in the UK came into place in January 2018 and currently 8% of digital customers are estimated to be using Open Banking in their daily lives – to put this into perspective 16% of people use Apple Pay and Google Pay which were launched in 2014 and 2015 respectively. With 800million Open Banking transactions across the country compared to 750million in Germany, France, Italy, Spain, Poland, Netherlands, Sweden, and Belgium combined, the UK has clearly taken the lead in this space.

We have gathered the key updates from the Open Banking Expo 2021 to provide insights into where Open Banking is headed and the key factors that are driving adoption.

What is the current state of adoption?

Open Banking is growing…fast. Providing clear proof of this growth, Token, an open banking payments platform, commented that they have seen a 664% increase in Open Banking payments from July 2020 – July 2021. While the topic of Open Banking has been readily discussed since its inception, Philip Low, Head of Partnerships at Codat observed that while the ‘why’ and the ‘what’ have been established, there is a need to discuss the ‘how’.

Who is driving education for consumers?

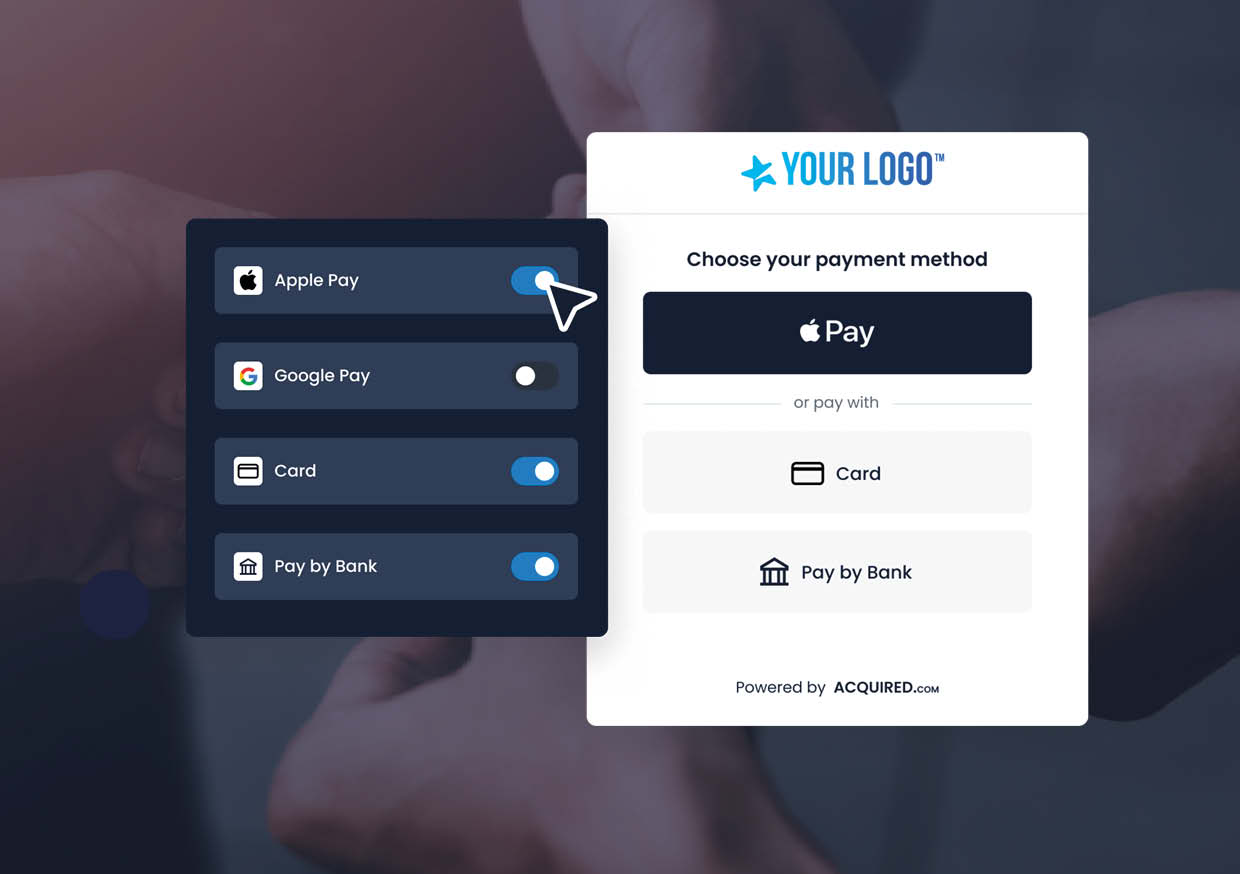

Educating consumers on new payment methods is typically achieved through marketing by those driving the change (Visa and MasterCard ‘the card schemes’ for Contactless Payments, Apple for Apple Pay, Google for Google Pay etc). However, until now Open Banking has been driven by regulation meaning that no-one is focussed on educating consumers on what Open Banking is.

However, this may not necessarily be a bad thing. Sujata Bhatia, COO, Monzo commented that consumer education will occur as propositions are created that deliver real value to their customers. Once they understand that organisations can provide superior products and services if granted access to their bank account then education will occur. Adoption will likely surge as consumers use products and services that drive them to Open Banking but they may not necessarily identify this process as Open Banking. In essence, the success of Open Banking will rely on its ability to add value to the consumer rather than promotion of the concept itself.

Sujata Bhatia also remarked that we are at the ‘tip of the iceberg’ when it comes to the commercial and societal benefits of Open Banking, particularly in relation to financial inclusion for the vulnerable in society. The topic of vulnerability also highlighted potential issues with the word ‘open’; it was suggested that while consumers might be interested in using Open Banking payment methods, a lack of education in the sector could lead to unfounded concerns about the security of their payment details.

Leveraging Open Banking insights for consumer lending

From a lending perspective, Open Banking provides valuable clarity when it comes to separating risk with medium risk consumers. Gerald Chappell, Chief Executive Officer & Co-Founder, Fintern suggested that while Open Banking does introduce friction into the lending journey, it is likely to become the norm for consumer lending in the coming years. Fintern are working towards 70% machine-led decisions and 30% machine-assisted decisions when it comes to lending approval. The ability to overlay Open Banking transaction data with traditional lending approval methods provides a more accurate view of a customer’s affordability. This increased transparency equips lenders with a rounded view of their customers and therefore the ability to provide a superior product for them. Open Banking will undoubtedly play a key role in the growth of Fintern and similarly AI driven lending businesses in the coming years.

Variable Recurring Payments

The need for transparency for both merchants and customers was touched upon frequently, in particular when discussing Variable Recurring Payments (VRP). VRPs connect customers payment details to authorised payment providers so they can make payments within agreed parameters on their customers behalf. The ability to provide security, transparency and an improved user experience paves the way for VRP to replace Direct Debit’s more blunt, bilateral approach to recurring payments.

Stephen Wright, Industry Engagement & API Standards Lead, NatWest commented that the incumbent banks are looking to be reactive to developments in this space, but it is currently unknown how VRPs (non-sweeping) will be delivered. An example of this is the lack of clarity around what the onboarding process look like for Third Party Providers (TPPs.) NatWest are keen to see a uniformed onboarding process across the market. However, ambiguity around liability and definition of ‘customers account’ means that it is likely every application will be considered on a case-by-case basis. This may create issues for smaller organisations that do not have the legal resources available to undertake this process.

Key takeaways from the Open Banking Expo

Collaboration and Partnership were highlighted as the key to success in this space and communication between banks and Open Banking platforms must remain transparent as this sector develops. With approximately 300 Payments Initiation Service Provides (PISPs) currently operating in the UK, consolidation is expected.

To-date the nine largest banks in the UK (CMA9) have incurred the costs of delivering Open Banking and it is the TPPs that have reaped the rewards. VRPs (beyond sweeping) represents a mutually beneficial opportunity for banks and TPPs alike if navigated correctly, however this will require strong collaboration between the banks and the TPPs to create a commercial model which generates value across all parties.