The FCA’s deadline for SCA compliance is fast approaching. This is a critical date for merchant’s regulated by the Financial Conduct Authority, as it impacts their incoming payments and the customer journey. So, how do you ensure you adhere to the regulation and how do you check if your payment gateway is SCA ready?

What is SCA?

Strong Customer Authentication is a set of requirements which are design to increase security and minimise fraud in online payments. The regulations will change how a consumer confirms their identity within the payment process. The new requirements introduced by the second Payment Services Directive (PSD2) mean that purchasers will need to verify their identity by completing an additional security step at checkout. This can be any two from the following three options:

- Something they know – such as a password or pin

- Something they own – such as a mobile phone

- Something they are – such as a fingerprint or facial recognition

Do I need to comply?

Businesses that accept payments online must comply with SCA before 14th March. All businesses that accept online payments must activate at least 3-D Secure 2.0 by this date to comply with this regulation. 3DS 2.0 supports increased fraud prevention and adapts easily for mobile and in-app experiences.

If a merchant does not take steps to comply with this regulation, they may experience:

- Declined transactions and loss of card sales

- Potential scheme fines

- Potential increased fraud risk

How do I check if my payment gateway is SCA ready?

If you process online payments, you will need to check that they are SCA compliant. We would recommend you speak to your solution provider to make sure their solution is up to date with all the requirements and that they are fully prepared for the SCA mandate.

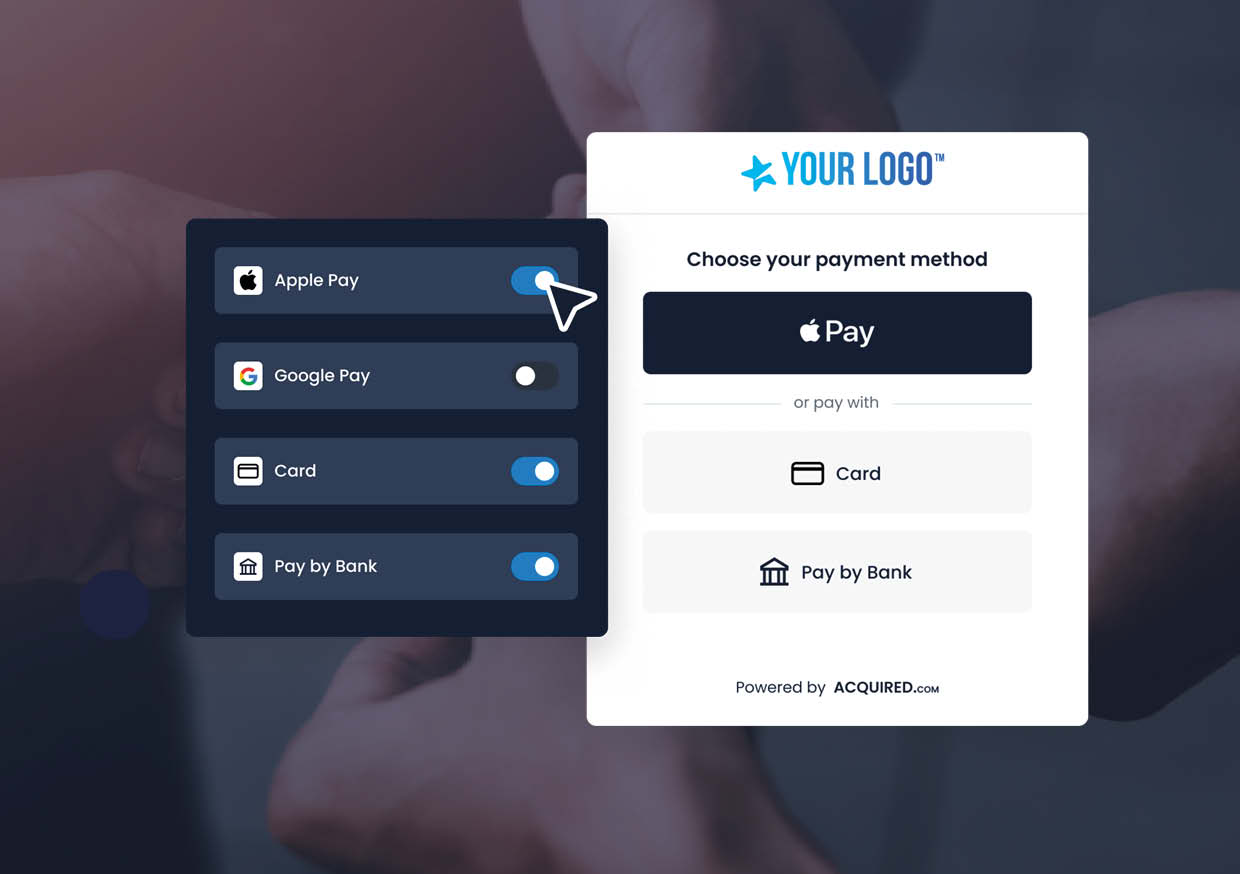

Acquired’s payment gateway utilises 3-D Secure v2.2 which mean you’ll stay SCA compliant and protect your business from fraudulent transactions and failed payments. Leveraging this technology can help merchants employ a more data-driven approach to customers and transactions in order to keep fraud and chargeback rates low. Our solution triggers SCA requests based on pre-set parameters and is ideally suited for online businesses who want to minimise development effort and enjoy a streamlined payment process.

Our gateway also supports wallet solutions including Apple Pay or Google Pay which are already SCA compliant and provide a frictionless checkout experience for consumers while meeting the new requirements.